Voluntary Contributions

This article was prompted by a very interesting question from one of our followers on Facebook recently:

“Is there going to be a mechanism for the personnel moved onto the 2015 scheme to buy added years between 2015 and 2022 on the 05 scheme, if they choose to move back onto that scheme for that period?”

This seemingly innocuous question set us poring over the Government’s latest consultation document for an answer and what follows is our current interpretation of the new proposals.

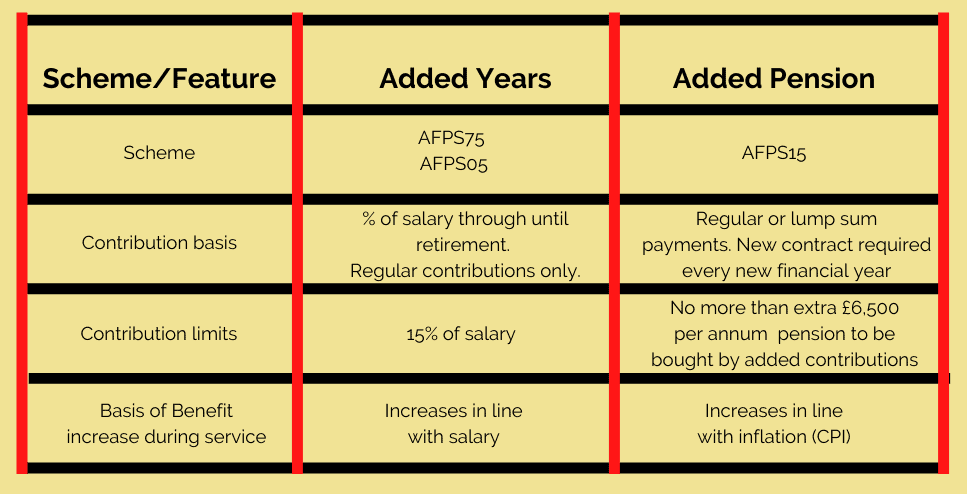

First it is important to understand the difference between purchasing Added Years (the terminology used for AVC benefits paid under AFPS75 or AFPS05) and Added Pension (the terminology used for extra benefits purchased by member contributions under AFPS15).

Relevant extracts from the consultation document:

Para A15; Under both immediate choice and deferred choice underpin options all additional benefits purchased via voluntary member contributions in the remedy period could be converted to an equivalent value of AP in the scheme that the member is not currently in. This equivalent value of AP would only be added to the member’s pension where they chose to join the alternative scheme design for the remedy period. Some legacy schemes’ regulations and administrative processes may need to be updated in order to provide for an AP facility

FPS interpretation

We know that members can only contribute on the basis of the scheme that they are in at the time of payment. Until the decision is made as to “Immediate Choice (IC)” or “Deferred Choice Underpin (DCU)”, members that have transferred across to AFPS15 (such as our questioner) will continue to be able to contribute on the basis of Added Pension (AFPS15) rather than Added Years.

If IC is chosen then contributions will continue to be paid on the basis of the “current” scheme throughout the remedy period. In the event that the member elects to revert back to AFPS05 (also for those that choose to revert to AFPS75) we expect that there will be an equivalent “added pension” benefit calculated for the remedy period (as opposed to Added Years).

Interestingly if the DCU option is selected by Government, members will be reverted to their legacy scheme for the remedy period, but as we don’t believe that this will happen before 2022, anyone that wishes to make additional contributions before April 2022 will presumably have to do so on the basis of their current scheme.

Under the above interpretations there would appear to be no scope for someone that has been moved to AFPS15 to subsequently have their added contributions treated as Added Years.

This seems a harsh interpretation as anyone that was kept on their legacy scheme, ie they were transitionally protected, will be able to continue to pay AVCs and secure added years up to the end of the remedy period.

The solution, of course, is to allow the added contributions paid during the remedy period to be converted to an equivalent Added Years benefit if the member ultimately chooses to revert back to their legacy scheme. This may yet be possible, and our current interpretations may be incorrect, it’s just that the above extract makes it look like ‘Added Pension’ will be the only alternative.

A further complication lies in the fact that post remedy period (ie from 1st April 2022 onwards) everyone will be on AFPS15. Existing Added Years contracts will presumably have to be reviewed/converted to Added Pension for contributions beyond that date.

So in conclusion, and to answer the Facebook query, we currently suspect that Added Years will not be an option, but matters are far from clear right now. FPS will of course refine our thinking (if necessary) and update members as matters develop.