For many service personnel, the end of summer heralds the nervous, unwelcome, wait for the previous tax year’s Annual Allowance (AA) usage notification.

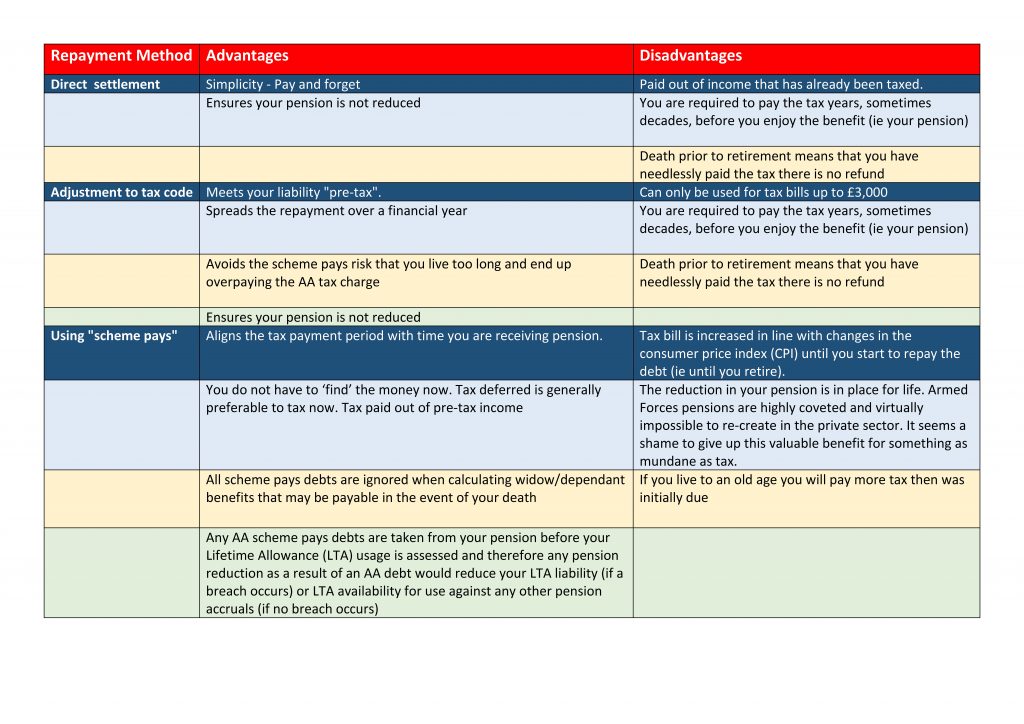

If you have an AA tax charge, do you know what your settlement options are? This table explains and gives the pros and cons of each settlement method?

Although we cannot give guidance on what will suit you best, as a generalisation we find that only smaller tax bills should be paid directly.

Larger tax bills (generally over £3,000) are more likely to be most efficiently met by “scheme pays”.