For those who have accrued pension benefits on AFPS 05 and/or AFPS 15 (but not AFPS 75), many will leave with an entitlement to Early Departure Payments (EDP) rather than an immediate pension.

The calculation, entitlement to and eligibility for EDP differs between the two schemes, so here we explain the differences.

In the first instance, it is important to understand the difference between a pension and an Early Departure Payment (EDP).

The pension is an accrued benefit that is based on your time served and salary, which will provide an income for you later in life.

EDP is a form of compensation paid to you in recognition of a shortened career until the pension comes into payment. It is based on the value of the pension. Like the pension, it provides an annual income and a tax-free lump sum.

EDP is not paid to everyone who leaves service, only those who reach the qualification criteria. The point at which EDP is payable on AFPS 05 is the 18/40 point; for AFPS 15 it is the 20/40 point. What this means for each scheme is that you must have reached the age of 40 and, in the case of AFPS 05, have 18 years of service or for AFPS 15, 20 years of service. Both conditions (age and years of

service) are required to qualify for the EDP point relevant to the scheme. If you leave service with an EDP entitlement, the pension benefit will be deferred to a later date.

In the case of AFPS 05, this is at the age of 65; for AFPS 15, this is your state pension age (SPA). When the pension comes into payment, the EDP stops.

You should be aware that service to the age of 55 (AFPS 05) and 60

(AFPS 15) will trigger immediate payment of the pension with no entitlement to EDP.

Those whose pension accrual is based on Reserve service (of any kind) do not qualify for EDP on either scheme. Medical officers and dental officers (MODOs) do not qualify for EDP from AFPS 05 if they have accepted MODO bonus terms and conditions. However, MODOs do qualify for AFPS 15 EDP.

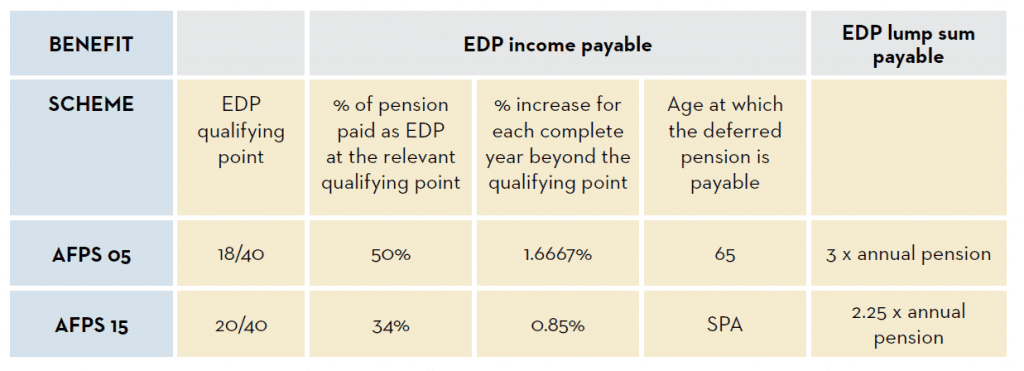

The calculation of the EDP payment is, for both schemes, based on a percentage of the deferred pension value. For each complete year of service beyond the EDP qualification point, that percentage increases by a fixed amount.

The table below illustrates the differences between the criteria applicable to each of the two schemes.

Let’s take a simple example to show how this works. A Warrant Officer Class 1 aged 42 with a total of 22 years’ service at their discharge date will have accrued benefits on both the 05 scheme and the 15 scheme. They reached the 18/40 and 20/40 EDP qualification point for both schemes at the same time, their 40th birthday. At the age of 42, they have served exactly two years beyond the EDP qualification point for both schemes.

The EDP is calculated like this:

AFPS 05: 50% + (2 x 1.6667%) = 53.3334%

AFPS 15: 34% + (2 x 0.85%) = 35.7%

If then the deferred pension value at discharge is as follows:

AFPS 05: £11,322 (deferred until age 65)

AFPS 15: £7,663 (deferred until state pension age) …

… the EDP annual income payable at discharge will be:

AFPS 05: £6,043.74 (£11,322 x 53.3334%)

AFPS 15: £2,735.69 (£7,663 x 35.7%)

The EDP tax-free lump sum will be: AFPS 05: £33,966 (£11,322 x 3) AFPS 15: £17,241.75 (£7,663 x 2.25)

Individual circumstances, such as a pension sharing order, may add a degree of complexity beyond this example. If you have any specific questions regarding EDP, and you are a member of the Society, please do contact the FPS pensions team.

Written for Pennant by Wendy Bandeira, FPS Senior Pensions Consultant