As you know, from 1st April 2022, everyone serving was transferred to AFPS15 which in fact remains one of the best public sector pension schemes in operation. There are numerous benefits to AFPS15 and here we highlight some of them.

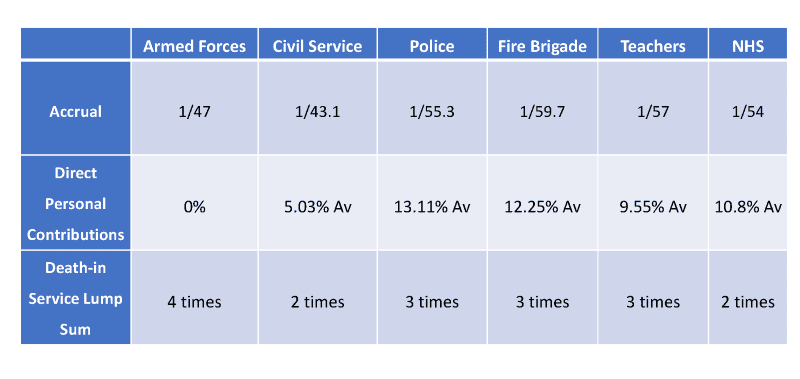

Let’s first of all look at why AFPS15 is still one of the best public sector pension schemes out there and not the bad relation everybody doesn’t want to talk about. The table below provides a useful summary of how it compares with other public sector schemes:

Now on to the basics: if you serve to the age of 60, your pension will be paid immediately you leave – if you exit earlier, (which is highly likely for most serving today), pension payments are deferred until state pension age. For every year you serve, the MOD adds 1/47th of your annual pensionable earnings to your individual pension. Each year, it increases in line with the Average Weekly Earnings Index, thereby retaining the value of your pension for the long term. So, ignoring any in-service revaluations and indexation, if someone was to earn £38,000 in any given year, based on the pension accrual rates shown above, the added amount to their pension would be:

Early Departure Payment (EDP): in order to encourage retention to at least age 40 (and assuming departure before age 60), for a 20-year minimum term, you will qualify for an EDP equivalent to at least 34% of your deferred pension, plus a tax-free lump sum equivalent to 2.25 times the deferred pension. This is quite separate from any pension you’ll receive at state pension age and is unique to the Armed Forces!

Buying Added Pension: this is extra pension you can purchase to increase your benefits on retirement – and I recommend you consider doing this. It’s very flexible- with a minimum contribution of just £25 a month. You can do it for a year at a time and include your spouse/partner if you wish. And it’s highly tax-efficient since payments into the scheme are taken from your gross pay before tax. The scheme not only delivers a bigger pension, but it also increases your EDP and lump sum. At the moment, the extra annual pension benefits you can buy is capped at £6,500pa.

Dependant’s Benefits: provided you have served more than two years at the time of your death, your spouse or civil partner will be eligible to receive a pension under AFPS15. If you die in Service, your spouse/civil partner or eligible partner will receive an immediate pension, paid for life, and a tax-free lump sum amounting to four times your final pensionable earnings. To ensure these benefits pass to the right person, you just need keep your personal details up to date with Joint Personnel Administration.

In summary, AFPS15 is still one of the best public sector pension schemes out there. The benefits compare very favourably with other schemes across the public and private sectors and the longer you are in it, the greater the rewards!

You can read here, the full article on the benefits of AFPS15.

If you’re not yet a member, to ensure you’re aware of the full details of the scheme and how the AFPS15 Remedy might affect you, join our growing membership, now well over 65,000.

You might also like Pension tips from the Team

IT PAYS TO UNDERSTAND YOUR PENSION!