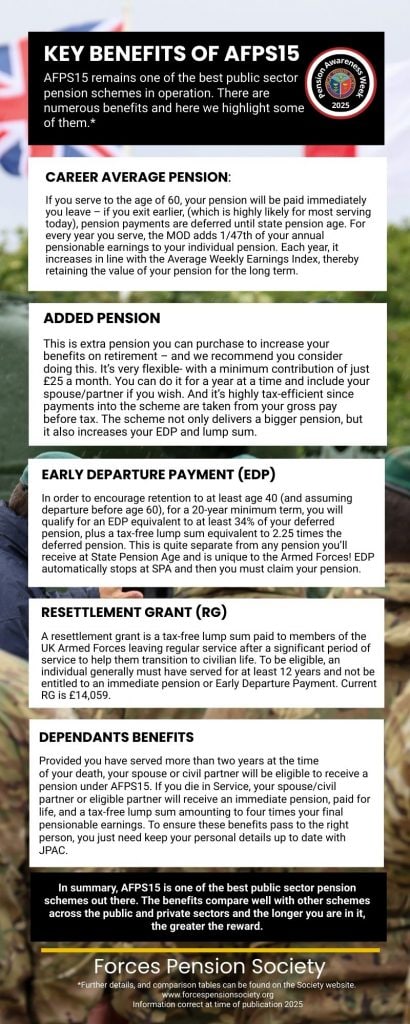

Did you know? AFPS15 is still one of the strongest public sector pension schemes available. It offers a wide range of valuable benefits, and we’ve highlighted some of the key ones below.

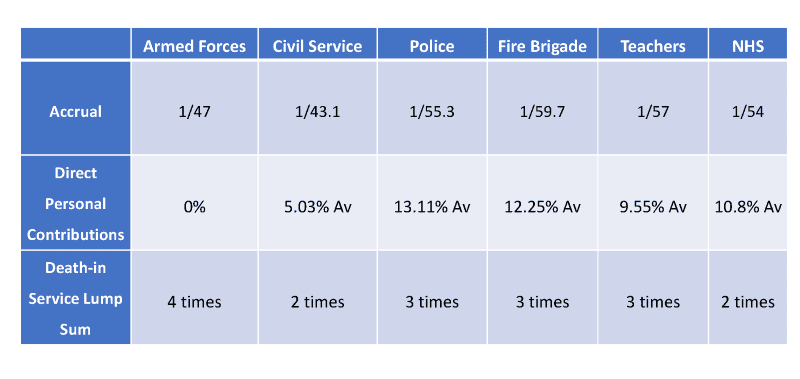

Before anything else, it’s worth looking at why AFPS15 continues to stand out as one of the top public sector pension schemes—far from being the “poor relation” some people assume it to be. The table below gives a helpful overview of how it compares with other public sector schemes.

Now on to the basics: if you serve to the age of 60, your pension will be paid immediately you leave – if you exit earlier, pension payments are deferred until state pension age.

For every year you serve, the MOD adds 1/47th of your annual pensionable earnings to your individual pension. Each year, it increases in line with the Average Weekly Earnings Index, thereby retaining the value of your pension for the long term.

So, ignoring any in-service revaluations and indexation, if someone was to earn £38,000 in any given year, based on the pension accrual rates shown above, the added amount to their pension would be:

Early Departure Payment (EDP): in order to encourage retention to at least age 40 (and assuming departure before age 60), for a 20-year minimum term, you will qualify for an EDP equivalent to at least 34% of your deferred pension, plus a tax-free lump sum equivalent to 2.25 times the deferred pension. This is quite separate from any pension you’ll receive at state pension age and is unique to the Armed Forces!

Buying Added Pension: this is extra pension you can purchase to increase your benefits on retirement – and we recommend you consider doing this. It’s very flexible- with a minimum contribution of just £25 a month. You can do it for a year at a time and include your spouse/partner if you wish. And it’s highly tax-efficient since payments into the scheme are taken from your gross pay before tax. The scheme not only delivers a bigger pension, but it also increases your EDP and lump sum.

Dependant’s Benefits: provided you have served more than two years at the time of your death, your spouse or civil partner will be eligible to receive a pension under AFPS15. If you die in Service, your spouse/civil partner or eligible partner will receive an immediate pension, paid for life, and a tax-free lump sum amounting to four times your final pensionable earnings. To ensure these benefits pass to the right person, you just need keep your personal details up to date with JPAC.

In summary, AFPS15 remains one of the strongest public sector pension schemes available. Its benefits compare extremely well with those offered across both the public and private sectors — and the longer you remain a member, the more substantial the rewards become.

Download our infographic here

Figures/content correct at time of writing Nov 2025