We talk a lot about Veterans unclaimed pensions, but do you know the rules around preserved/deferred pensions? Here we set them out, in the hope that you better understand what they are, your eligibility and how to claim.

So What Is It?

- Is simply a benefit you have earned by virtue of reckonable employment, but which is not paid to you until you reach an age at which the scheme rules allow you to draw it.

- Until it can be drawn, it is held on your behalf and the value uplifted each year in line with the Consumer Price Index (CPI). Once you reach the age stipulated by the scheme rules, then you can draw the benefit. Alternatively, on leaving employment early, you can choose to transfer the value of your earned benefits into another Final Salary/Defined Benefit scheme. Armed Forces benefits may not be transferred to an overseas scheme or a Defined Contribution scheme (AFPSs are Defined Benefit (DB) schemes).

- Contrary to popular belief, all the schemes (AFPS75, AFPS05 and AFPS15) have provision for preserved pensions (known as deferred pensions under AFPS15), as most scheme members will not serve until their Immediate Pension Point (AFPS75) or Normal Pension Age (AFPS05 and AFPS15). For those with service prior to 1975 however, the rules were very different.

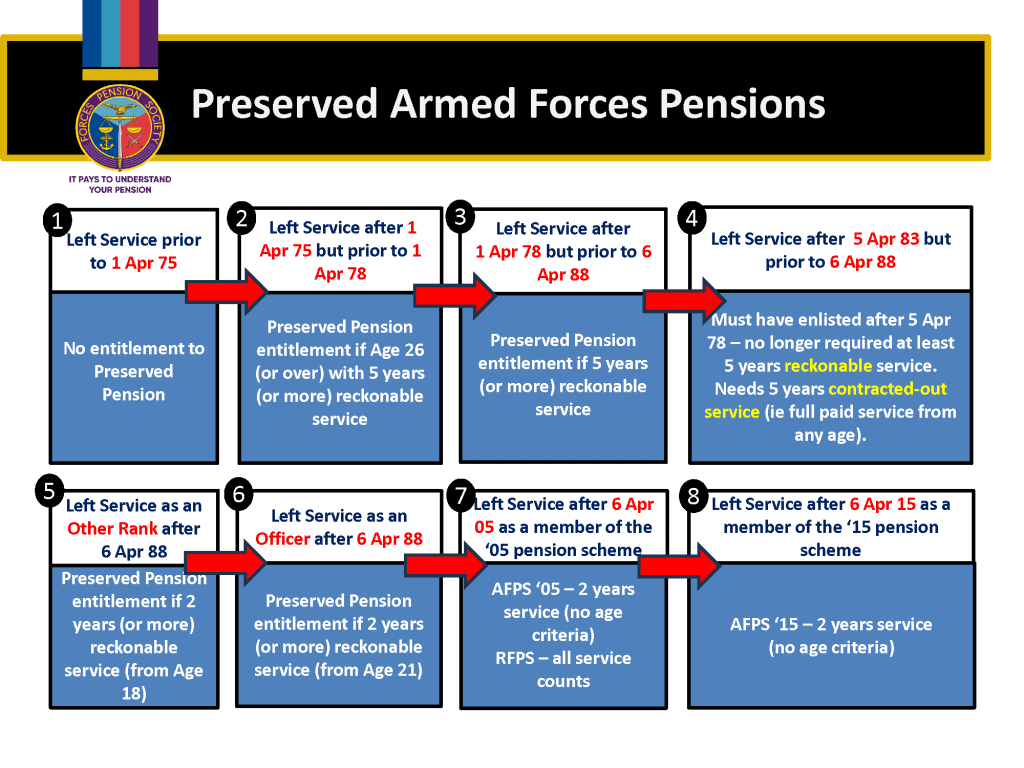

WHO QUALIFIES?

The chart below explains in simple terms elibility for preserved/deferred benefits (click image for a downloadble copy)

There are a select few however, who unfortunately will still not have any preserved pension benefits. These are people who joined on non-pensionable terms (predominantly gratuity-earning short service commissions), members of the Volunteer Reserve, personnel who opted out of the Armed Forces Pension Scheme, and those who transferred their benefits into another occupational pension scheme.

How Do I Claim?

All scheme members should receive an annual statement, but there are a significant number of instances where individuals have not informed their provider of a change in address/contact details. You can find details of who to contact here.

It is advised that you act to claim your preserved pension approximately three to six months before it is due to come into payment; again, the ages at which this applies vary by time and scheme so having established from the previous section that you are entitled to a preserved pension, the ages at which benefits are payable are:

- AFPS 75. Preserved benefits earned up to and including 5 April 2006 service will be paid at age 60. Benefits for service after this date will be paid at 65. You can elect to take all your preserved benefits at age 60, but the benefits which would ordinarily have been due at age 65 will be actuarily reduced to reflect the early payment.

- AFPS 05. Preserved benefits will be paid at age 65.

- AFPS 15. Deferred pensions will be paid at your State Pension Age.

In order to claim your preserved (or deferred) pension, you must apply to the scheme administrator approximately six months before it is due to come into payment. This is done by completing an AFPS Form 8 and submitting it to Veterans UK at Glasgow.

You may download this page here.