As you approach your run-out date there is so much admin to do, and one of the final things you will have to deal with concerning your time in the Services is your P45.

In this article written for Easy Resettlement Magazine we explain what a P45 is and what you should do with it.

The P45 is a form which is generated by the pay computer and sent to you after you have received your final pay statement. It shows details of your tax code, when in the tax year you left, how much you earned up to that point and how much tax you have paid during that tax year. It also contains your name, date of birth and National Insurance Number. Employers are obliged to send you a P45 by law – if you don’t receive one, you should ask for it.

The form comes in four parts but you will only receive three. Part 1 will have been sent by the pay authorities directly to your tax office. Parts 1A, 2 and 3 are the parts which will come to you.

Part 1A is for your records, so hang on to it – it may help you (or your accountant) if you are going to have to fill in a Self-Assessment Tax Form. You would be self-assessing if, for example, you left with a Immediate Pension (IP) or AFPS05/AFPS15 Early Departure Payment (EDP) Scheme benefits in payment and had other paid work or taxable income.

Parts 2 and 3 are for your new employer. If you are going straight to a new job, you should hand Parts 2 and 3 to your new employer. That will allow them to get your tax right from the outset. If you leave before final pay run, or work during your terminal leave, you will not have your P45 to give your new employer. In these circumstances, you will be taxed on an emergency tax code which assumes that you have no tax free allowance. That could see you paying more tax than is necessary for a short period but, as soon as the relevant parts of the P45 are handed over, your tax will be adjusted in accordance with the tax information that the P45 contains. Before you get too excited, this will not necessarily mean a tax rebate. Use of an emergency tax code means that the employer takes 20% tax on everything you earn in your new employment. However, some of you will have a 40% tax liability on some of your earnings, so the application of the emergency tax code could result in a tax bill!

If you have no job lined up but intend working, it is a good idea to sign on at Job Centre Plus and hand them Parts 2 and 3 of your P45. If you’re leaving with an IP or EDP income you might think there is no point, as the level of your income means that you are not entitled to benefits. However, by signing on, your National Insurance Contributions (NICs) will be kept up to date by Job Centre Plus and this matters as NICs contribute to your State Pension entitlement. Remember, you need 35 years’ worth of NICs to qualify for a full State Pension, so every contribution matters. When you find a job, Job Centre Plus staff will give you an updated P45 for you to hand to your new employer.

If you are not intending to work or you are going to be self employed you should send Parts 2 and 3 of the P45 to HMRC. It may well be that, if you are not intending to work, HMRC will reassess the tax you have paid up until your date of discharge and refund any over-payment. Whatever you do, do NOT put any part of the P45 in the bin. Remember that the P45 contains lots of lovely personal data which could be very useful to unscrupulous people who would love to misuse it.

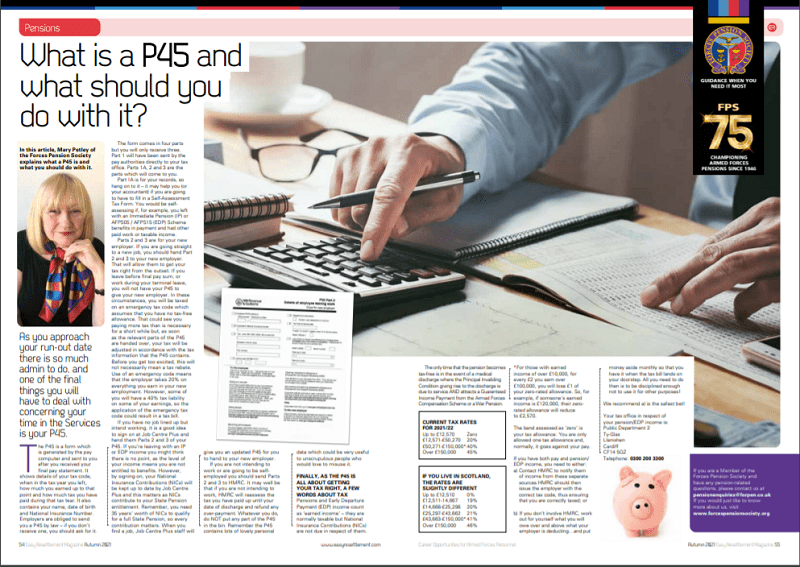

FINALLY, AS THE P45 IS ALL ABOUT GETTING YOUR TAX RIGHT, A FEW WORDS ABOUT TAX

Pensions and Early Departure Payment (EDP) income count as ‘earned income’ – they are normally taxable but National Insurance Contributions (NICs) are not due in respect of them. The only time that the pension becomes tax-free is in the event of a medical discharge where the Principal Invaliding Condition giving rise to the discharge is due to service AND attracts a Guaranteed Income Payment from the Armed Forces Compensation Scheme or a War Pension.

CURRENT TAX RATES FOR 2021/22

Up to £12,570 Zero

£12,571-£50,270 20%

£50,271-£150,000* 40%

Over £150,000 45%

IF YOU LIVE IN SCOTLAND, THE RATES ARE SLIGHTLY DIFFERENT

Up to £12,510 0%

£12,511-14,667 19%

£14,668-£25,296 20%

£25,297-£43,662 21%

£43,663-£150,000* 41%

Over £150,000 46%

*For those with earned income of over £10,000, for every £2 you earn over £100,000, you will lose £1 of your zero-rated allowance. So, for example, if someone’s earned income is £120,000, their zero rated allowance will reduce

to £2,570.

The band assessed as ‘zero’ is your tax allowance. You are only allowed one tax allowance and, normally, it goes against your pay. If you have both pay and pension/ EDP income, you need to either:

a) Contact HMRC to notify them of income from these separate sources. HMRC should then issue the employer with the correct tax code, thus ensuring that you are correctly taxed; or

b) If you don’t involve HMRC, work out for yourself what you will owe over and above what your employer is deducting…and put money aside monthly so that you

have it when the tax bill lands on your doorstep. All you need to do then is to be disciplined enough not to use it for other purposes!

We recommend a) is the safest bet!

Your tax office in respect of your pension/EDP income is:

Public Department 2

Ty-Glas

Llanishen

Cardiff

CF14 5QZ

Telephone: 0300 200 3300

Read the Autumn issue of Easy Resettlement here

Image Source: HMRC