The new tax year began 6 April 2023, and you may well be thinking about how your tax affairs will work once you have left the Armed Forces.

Whether you are intending to work or not, and irrespective of whether you have pension or Early Departure Payment (EDP) Scheme income, in this short article written for the April issue of Pathfinder Magazine we explain the basics.

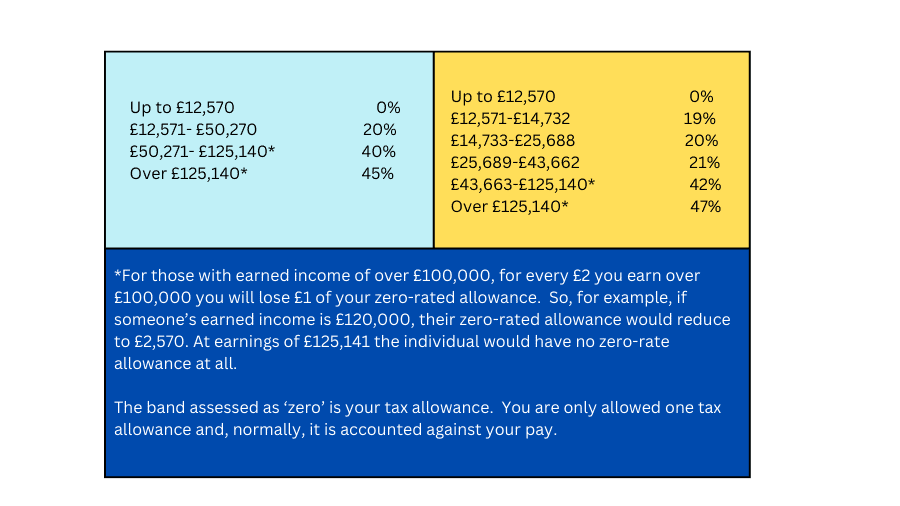

Pensions and EDP income count as ‘earned income’ – they are normally taxable but National Insurance Contributions are not due in respect of them. The 2023/24 income tax rates are:

If you have both pay and pension and/or EDP income, you need to either:

- Contact HMRC to notify them of income from these separate sources. HMRC should then issue the employer with the correct tax code, thus ensuring that you are correctly taxed; or

- If you don’t involve HMRC, work out for yourself what you will owe over and above what your employer is deducting …. and put money aside monthly so that you have it when the tax bill lands on your doorstep. All you need to do then is to be disciplined enough not to use it for other purposes!

We recommend the former as the best solution.

If you are going to be self employed, you will need to declare your pension/EDP income, and the tax paid on it, on your annual Self Assessment tax return. You will be issued with a P60 each year to help you with this.

The default position is that Armed Forces pensions are normally taxable in the UK. If you move abroad and your pension is being taxed in UK, check here and arm yourself with a copy of any Double Taxation Agreement which exists between the UK and your new country of residence – then, in order to prevent your money from being taxed twice, make sure your accountant in your chosen country is aware of it.

There are some countries in which you can choose to have your pension taxed under the local tax regime and there are others that insist on the tax being paid in the country of residence. Wherever you are going to live, go armed with the latest information – and remember that tax rules do not remain static!